Acquisition Costs Tax Treatment

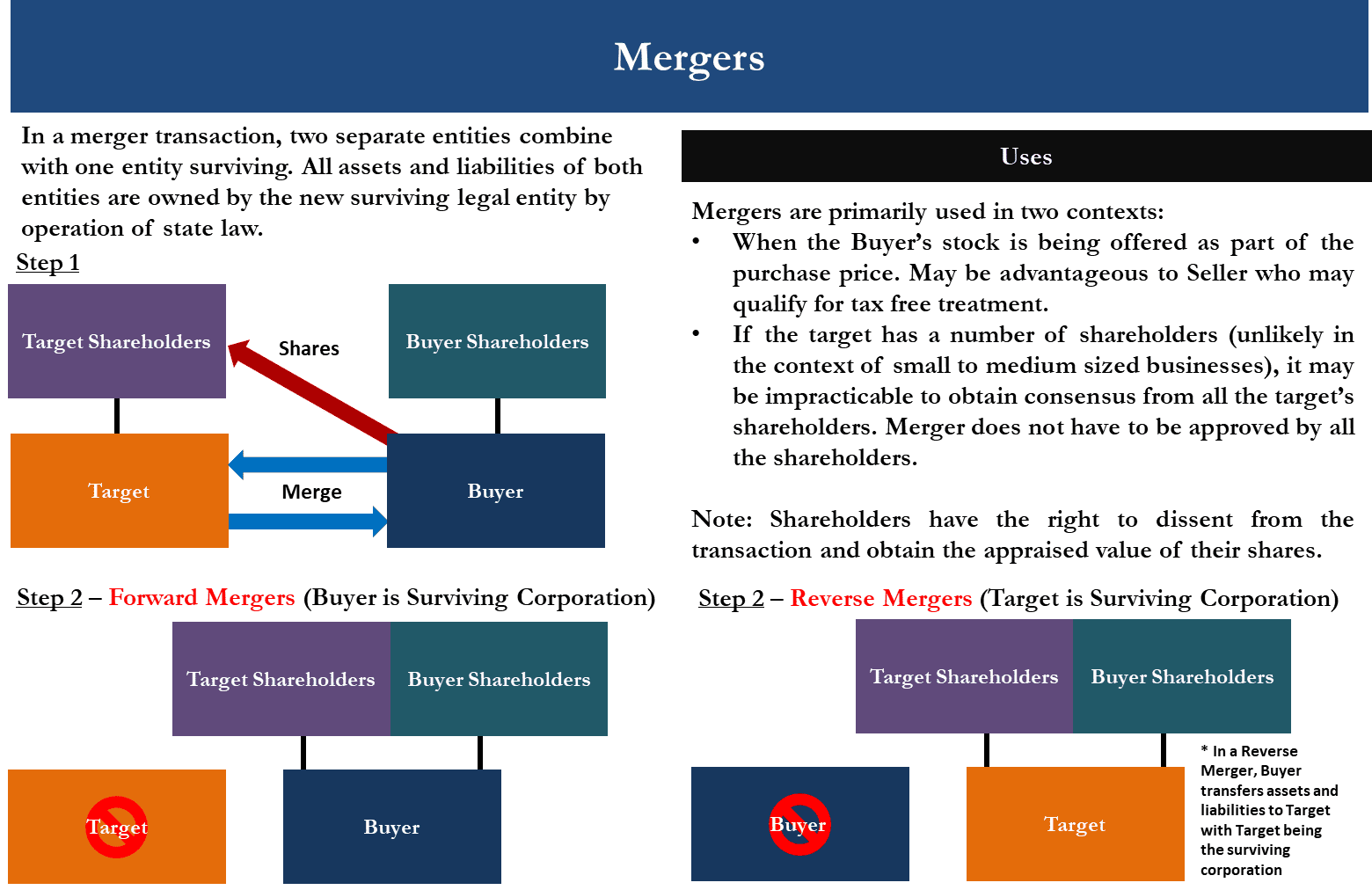

Acquisition costs tax treatment. Increases the basis of stock acquiredTaxable sale of assets by the taxpayer. When dealing with property a taxpayer may incur transaction costs sometimes called indirect costs. Tax treatment is generally the same as the book treatment.

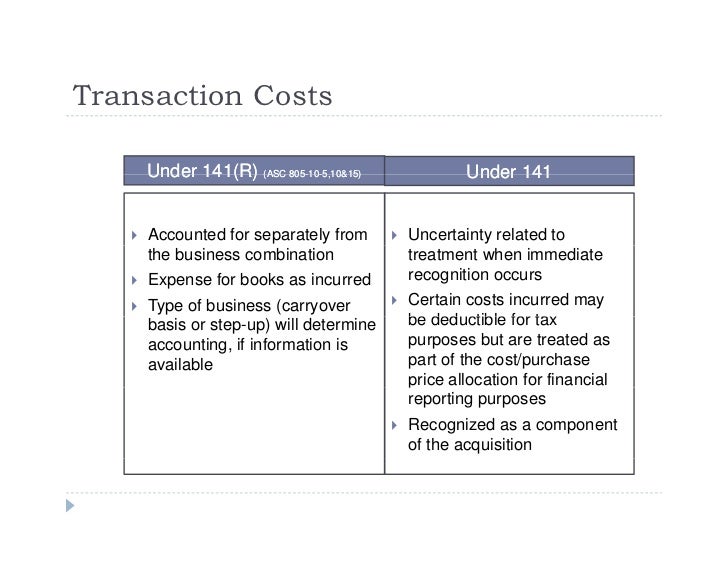

Costs that facilitate the following types of transactions are treated as followsTaxable acquisition of assets by the taxpayer. 1263 a-4 provides that certain internal costs eg employee compensation and overhead and de minimis costs are not required to be capitalized for tax purposes. 1263 a-4 and 1263 a-5.

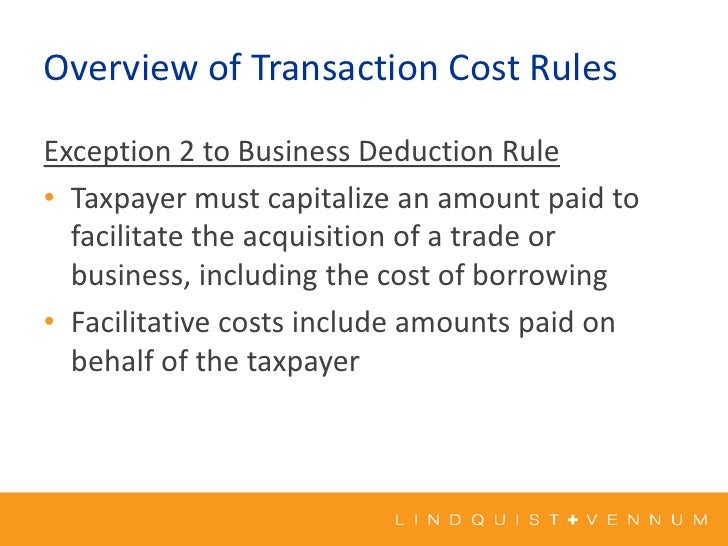

The regulations provide guidelines for determining whether expenditures facilitate a transaction. Determine how the taxpayer should treat facilitative costs it must capitalize depending on the party target or acquirer and the type of transaction eg asset stock or tax-free acquisition. These costs include amounts paid in the process of investigating or otherwise pursuing the transaction.

However for certain acquisitive covered transactions defined in Treasury Regulation Section 1263 a-5 f a portion of the costs may be treated as non-facilitative of the transaction and depending on the facts such costs would be currently deductible or amortizable. The timing and nature of these expenses will for the most part determine the tax treatment. The cost of intangible assets with a limited life may also be depreciated for tax purposes.

Lease acquisition costs. For example fees paid to an investment banker for debt financing and advisory fees in connection with an acquisition. If the ultimate buyer often a private equity group PEG creates a substantive legal entity buyer to complete the acquisition the PEG will sometimes fund.

On an acquisition of business assets typically no tax covenant is given and there would be fewer tax warranties because in general the tax liabilities do not attach to the business assets and. Reduces the amount realized on asset sale. For tax years ending on or before December 31 2003 involving transaction costs incurred before December 31 2003 in determining whether to audit the propriety of the taxpayers treatment of transaction costs in the acquisition of a trade or business the auditor should consider whether the taxpayers return position falls within the prior Examination results referenced above.

Any facilitative costs that are incurred prior to the execution of an LOI may also be deducted provided they are not inherently facilitative. For example the cost of licenses franchises and concessions may be depreciated over the life of the asset.

Both book and tax require the capitalization of lease acquisition costs.

Any facilitative costs that are incurred prior to the execution of an LOI may also be deducted provided they are not inherently facilitative. The rules for the treatment of costs to acquire or create the various types of intangible assets are found in Regs. Generally costs that facilitate a transaction must be capitalized. 1263a-5 depends on whether the acquirer or the seller incurs the costs in the transaction whether the acquisition is an asset acquisition or a stock acquisition and whether the transaction is taxable or tax free. These costs include amounts paid in the process of investigating or otherwise pursuing the transaction. Increases the basis of assets acquiredTaxable acquisition of stock by the taxpayer. For tax years ending on or before December 31 2003 involving transaction costs incurred before December 31 2003 in determining whether to audit the propriety of the taxpayers treatment of transaction costs in the acquisition of a trade or business the auditor should consider whether the taxpayers return position falls within the prior Examination results referenced above. If the ultimate buyer often a private equity group PEG creates a substantive legal entity buyer to complete the acquisition the PEG will sometimes fund. Costs that facilitate the following types of transactions are treated as followsTaxable acquisition of assets by the taxpayer.

Lease acquisition costs. The tax treatment of costs capitalized under Regs. Determine how the taxpayer should treat facilitative costs it must capitalize depending on the party target or acquirer and the type of transaction eg asset stock or tax-free acquisition. Costs that facilitate the following types of transactions are treated as followsTaxable acquisition of assets by the taxpayer. However for certain acquisitive covered transactions defined in Treasury Regulation Section 1263 a-5 f a portion of the costs may be treated as non-facilitative of the transaction and depending on the facts such costs would be currently deductible or amortizable. Any facilitative costs that are incurred prior to the execution of an LOI may also be deducted provided they are not inherently facilitative. For example the cost of licenses franchises and concessions may be depreciated over the life of the asset.

Post a Comment for "Acquisition Costs Tax Treatment"